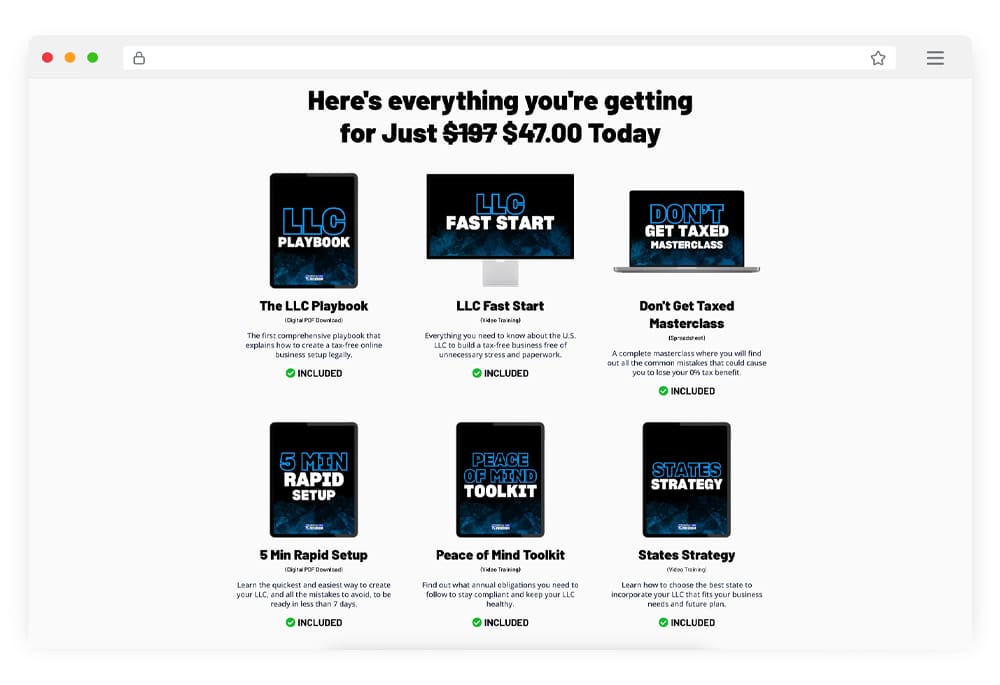

The LLC No-Tax Strategy is a step-by-step course designed for non-U.S. digital entrepreneurs who want to legally reduce their taxes to 0%. Without needing U.S. residency, offshore accounts, or complex legal structures, this training teaches you how to set up a U.S. LLC the right way.

You’ll learn how to choose the best state, stay compliant, avoid double taxation, and protect your income. Ideal for freelancers, nomads, and online business owners, this course provides a simple, affordable, and stress-free method to run a global business with peace of mind – and without losing profits to taxes.

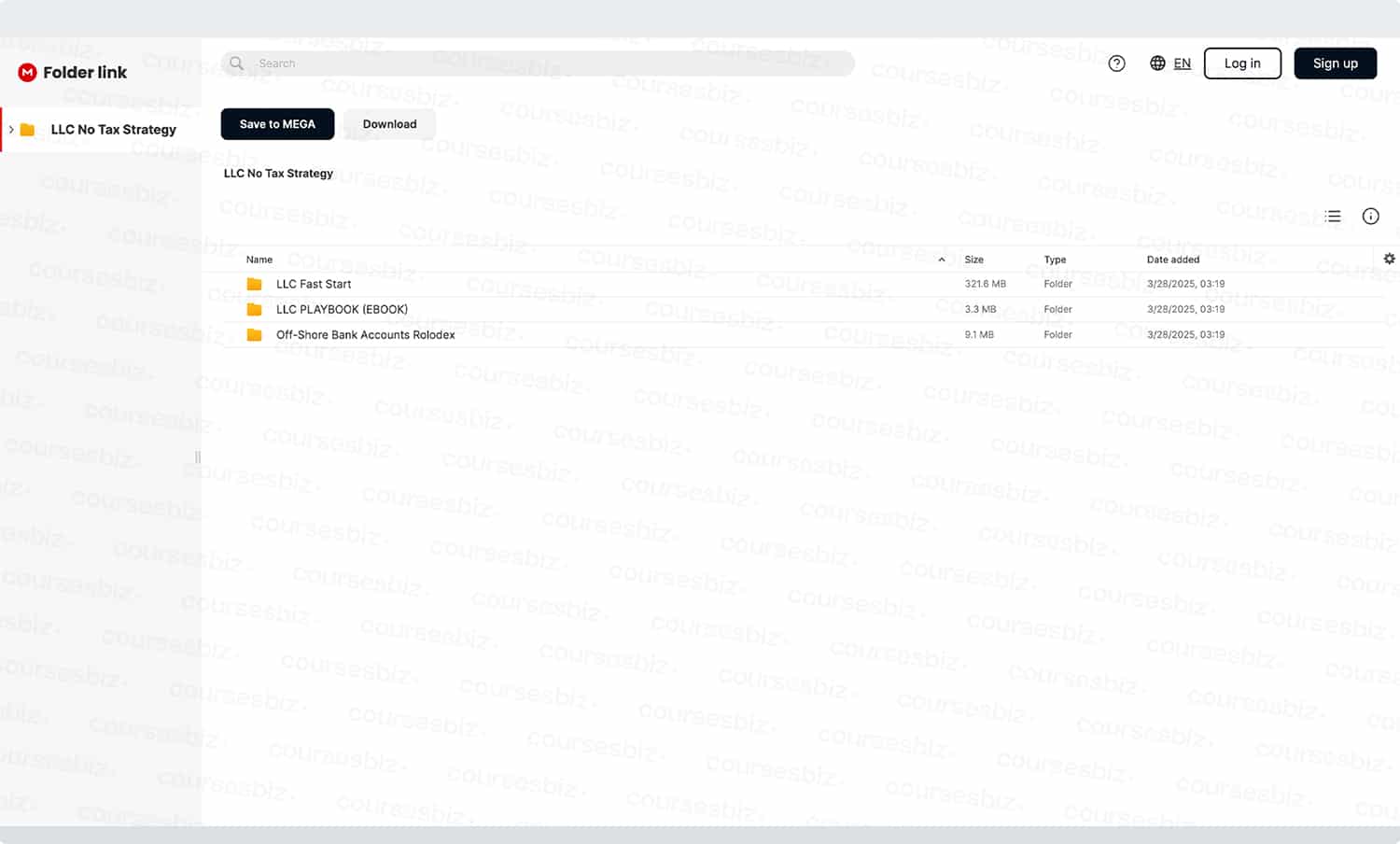

LLC No-Tax Strategy Download Proof 334 MB

The LLC No-Tax Strategy Helps You Legally Pay 0% – Without Moving or Hiding

Many online entrepreneurs believe tax freedom means moving abroad or hiding money. In truth, it doesn’t. The LLC No-Tax Strategy shows non-U.S. founders how to pay 0% legally – without relocating, breaking the law, or setting up anything shady. This approach works by using a U.S. LLC structure that benefits from legal non-resident tax rules. You won’t need an accountant, lawyer, or any complicated system.

Use a Clean, Simple System Built for Digital Business

If your customers aren’t in the U.S. and you live outside the U.S., this can work for you. The course walks you through everything: picking the right state, registering your LLC, and staying compliant year after year. It also explains how to protect your identity and keep income safe.

You’ll discover how to avoid double taxation and remain legally compliant in your home country. There’s no fluff – just a straightforward system designed to protect your profits. If taxes are holding you back, this may be the most useful $47 you ever spend.

Set Up a Zero-Tax U.S. LLC in Days With the LLC No-Tax Strategy

Creating a U.S. LLC might sound overwhelming. But it’s surprisingly simple when you follow the right system. The LLC No-Tax Strategy was made for digital nomads, freelancers, and remote founders who want fast results without legal confusion. You don’t need to hire a lawyer or wait months for approval. With this course, you can be fully set up in less than a week.

Inside, you’ll find step-by-step instructions that cover every detail. From choosing the right state to staying compliant – it’s all there. You’ll even learn how to open a U.S. bank account remotely. The best part? No hidden fees or tricky upsells.

This course keeps things beginner-friendly, clear, and practical. If you’ve been stuck Googling “how to start a U.S. LLC,” this is your shortcut. After just a few hours, you’ll have a structure that protects your income and helps you keep more of your money.

LLC No-Tax Strategy Gives You Protection, Privacy, and Peace of Mind

If you’ve ever worried about legal risks, tax audits, or protecting your assets while running your business globally, this course offers real peace of mind. The LLC No-Tax Strategy helps you build a structure that protects your business and personal identity – all while reducing your taxes to zero.

-

Protect Your Personal Assets: Learn how to separate your personal finances from your business, so your home, savings, and belongings stay safe if anything goes wrong.

-

Keep Your Identity Private: The course walks you through setting up an LLC without exposing your name or personal details to public records, giving you true business privacy.

-

Avoid Legal Headaches: Discover how to meet all legal requirements without stress, so you never have to worry about missing forms or making costly compliance mistakes.

-

Reduce Audit Risk: Follow a clear structure that aligns with U.S. tax law, helping you avoid red flags and stay off the IRS radar – even as a non-resident.

-

Run Your Business With Confidence: With everything in place, you can focus on growth instead of legal issues or financial surprises. This setup gives you the freedom to operate stress-free from anywhere in the world.

Stop Letting Taxes Eat Your Business – There’s a Simpler, Legal Way

High taxes don’t just drain your profits – they drain your motivation too. Most business owners know they’re overpaying but don’t know what to do about it. The LLC No-Tax Strategy offers a clean, proven alternative. Instead of relying on loopholes or hiring expensive consultants, it gives you a simple U.S. structure that works.

Finally, a Tax System That Makes Sense

This course breaks down every step. You’ll learn how to set up your LLC, stay compliant, and avoid getting taxed in two countries at once. You’ll also discover how to handle ongoing requirements without stress. Templates, checklists, and clear video lessons guide you the whole way.

Plus, it’s built specifically for non-residents with online businesses. If you want to scale without tax stress slowing you down, this may be your smartest move yet.

Most Online Entrepreneurs Overpay – Here’s the Framework They Don’t Teach

Most online entrepreneurs assume high taxes are just a part of doing business. But that’s usually because no one shows them another way. The LLC No-Tax Strategy is the alternative they’ve been missing. It introduces a simple, legal framework for setting up a U.S. LLC as a non-resident – specifically built to help you keep more of your income.

There’s no need for shady loopholes, risky offshore setups, or confusing tax schemes. This method is grounded in clear U.S. tax law and designed for people who want to run a lean, global business with zero stress.

How U.S. LLC Laws Protect Non-Residents From Paying Taxes

If you don’t live in the U.S. and your clients are also outside the country, the IRS typically doesn’t require you to pay U.S. income taxes. That’s exactly what this course helps you take advantage of. It teaches you how to register your LLC in the right state, avoid common compliance mistakes, and stay legally protected.

You’ll also discover how to avoid paying tax in your home country by managing income flow the smart way. With practical videos, checklists, and templates, this is the framework that finally puts you in control – without the headaches.

Skip the Tax Loopholes and Set Up Something That Actually Works

Chasing loopholes and shady tax tactics usually leads to more paperwork, more anxiety, and more risk. If you’ve tried them before, you already know that. That’s why The LLC No-Tax Strategy focuses on what actually works. It’s a straight-line, beginner-friendly path to 0% taxes using a U.S. LLC.

Designed for non-U.S. entrepreneurs, this course teaches a clean, compliant method to set up and maintain a business structure that protects your money – and your peace of mind.

Use a Legally Recognized U.S. Business Model

This strategy isn’t a trick or workaround. It’s based on how U.S. law treats non-resident LLC owners. If you follow the rules, you can run your business and keep 100% of your profits – legally. Inside the course, you’ll learn exactly how to choose the right state, open a U.S. bank account, meet annual requirements, and stay out of trouble with your home government.

Plus, you’ll avoid all the red tape that usually comes with international tax setups. If you want a structure that scales with your business, this is the one that works – without loopholes or guesswork.

Most Online Entrepreneurs Overpay – Here’s the Framework They Don’t Teach

Thousands of online entrepreneurs overpay in taxes every year, not because they want to – but because they don’t know any better. Most assume the only way to reduce taxes is to move abroad, hire expensive advisors, or set up some overly complex international structure.

But The LLC No-Tax Strategy teaches a much simpler method – one grounded in U.S. tax law that benefits non-resident founders. You don’t need tricks or loopholes. Instead, you follow a clear, legal process to structure your business in a way that allows for 0% taxation.

This isn’t theory or fluff – it’s a tested framework used by location-independent founders who run real businesses without drowning in paperwork or fear of audits. It’s the shortcut most accountants never talk about.

Escape the Tax Trap With This LLC No-Tax Strategy Training

If you’re building an online business and feel like taxes are always chasing your profit, you’re not alone. Most founders fall into the same trap: earning more only to owe more. But there’s a legal way out – and it starts with understanding how U.S. LLCs treat non-residents.

The LLC No-Tax Strategy shows you how to create a structure that frees your income from tax liability while staying fully compliant. You’ll learn how to avoid double taxation, manage your LLC from anywhere, and keep your business clean and lean. No stress.

No shady tricks. Just a modern system that’s designed to help digital entrepreneurs finally stop overpaying and start growing. Whether you’re freelancing or scaling a global brand, this training can unlock a better path forward.

You Don’t Need Offshore Accounts – You Just Need the Right LLC

Setting up offshore accounts might sound glamorous or clever, but in reality, it often leads to stress, red flags, and more complexity than it’s worth. That’s why The LLC No-Tax Strategy focuses on something far smarter – a U.S.-based LLC structure that lets you pay 0% tax legally, without leaving your home country.

It’s simple to set up, fully compliant, and gives you access to benefits like U.S. bank accounts, asset protection, and worldwide credibility. You don’t need to hop borders or hide money. You just need to follow the right legal process, and this course gives you the exact steps.

For digital nomads, freelancers, or remote business owners, it’s a game-changing solution that replaces confusion with confidence. This strategy works – and it works for the long haul.