FX Masterclass 2.0 by Uprise Academy is a complete, step-by-step training designed to turn beginners into confident, consistent traders. With nine in-depth phases and over 50 video lessons, you’ll learn everything from Forex fundamentals to technical, fundamental, and sentiment analysis.

The program covers tools like TradingView and Metatrader, teaches risk management and trading psychology, and walks you through building your own profitable trading plan. Whether you’re brand new or struggling with inconsistency, this course helps you trade with structure, clarity, and confidence. Join over 10,000 students worldwide who are mastering the markets and turning trading into a full-time career.

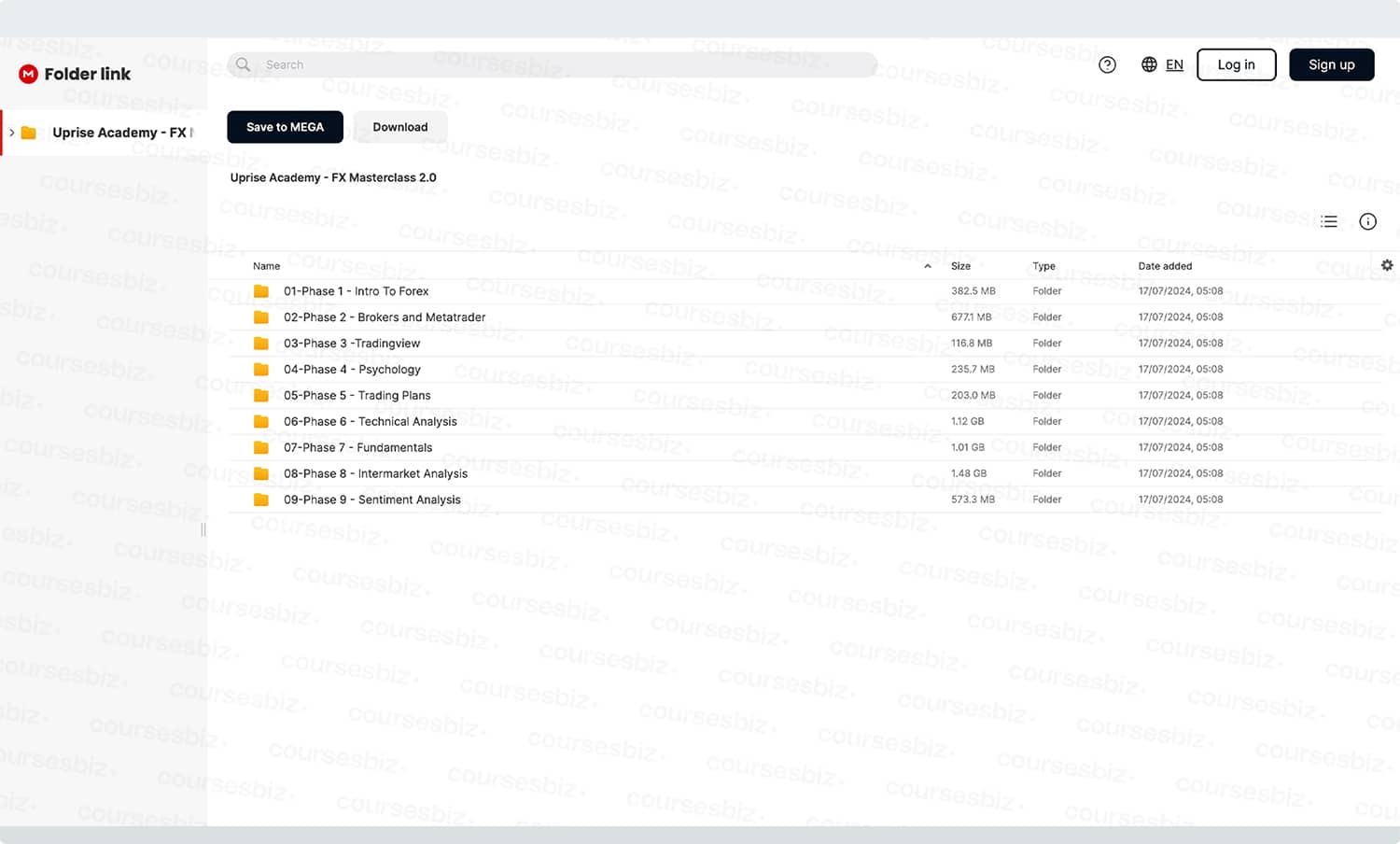

FX Masterclass 2.0 Download Proof 5.75 GB

FX Masterclass 2.0 Turns New Traders Into Confident Analysts

Most new traders skip the basics and rush into setups they don’t understand. FX Masterclass 2.0 fixes that. It starts with a complete breakdown of Forex itself – why it exists, when to trade, and what assets matter most.

You’ll learn how the market really moves before ever placing a trade. From there, the course walks you through Metatrader, TradingView, and everything you need to execute with confidence. Instead of reacting to price, you’ll understand structure, timing, and setups.

Intro to Forex and Sessions

Once your foundation is built, you’ll develop real chart fluency. You’ll learn session behavior, clean entry techniques, and how to use multiple tools together. Uprise makes technical analysis feel logical – not overwhelming.

Everything from candlesticks to confluence gets broken down into simple, repeatable skills. You’ll also avoid the confusion of signal chasing by using a process that works in any market.

Whether you’re starting from zero or returning after past losses, this course gives you what most traders never get: a complete understanding of how to analyze price action with confidence. That’s how consistent traders think – and how they win.

Learn Uprise Academy’s Psychology Tactics for Consistent Trading

A trading system is useless without the discipline to follow it. That’s why FX Masterclass 2.0 dedicates an entire phase to trading psychology. It shows you the emotional traps that ruin promising traders – impulsiveness, FOMO, overconfidence – and teaches you how to avoid them.

This isn’t surface-level mindset fluff. You’ll learn the habits and internal systems needed to survive long enough to get good. You’ll build mental consistency alongside your trading plan.

Trading Mindset and Risk Discipline

Inside this phase, you’ll examine why traders sabotage their own setups, and how to build rules that protect your capital. Uprise teaches you to think like a professional: accept risk, delay gratification, and let data guide your decisions.

Topics like account growth vs. flipping, patience, and teachability become real tools – not buzzwords. You’ll also learn how to emotionally detach from losses, while staying fully committed to your process.

Trading success doesn’t come from strategy alone. It comes from staying stable under pressure. If you’ve ever let emotion wreck a trade, this phase gives you the tools to stop that cycle – for good.

Master Sentiment and Fundamentals for Market Timing Precision

If you don’t understand why the market moves, you’ll always trade behind it. FX Masterclass 2.0 teaches you how to use both fundamental drivers and sentiment signals to anticipate price direction – before most traders see it coming.

You’ll learn how news, central banks, and macroeconomic trends impact price in ways that technical analysis alone can’t explain. This insight gives you an edge on timing, entries, and conviction.

Central Banks and Market Reactions

You’ll master topics like interest rate expectations, geopolitical risk, and institutional positioning – then learn how to turn that into tradeable setups. Uprise also trains you to read market sentiment: what traders feel, what they fear, and how it moves price. When the market gets emotional, most traders lose control.

You’ll capitalize on that chaos. Combining sentiment and fundamentals helps you time larger moves and understand context behind volatility. Instead of being surprised by reversals, you’ll prepare for them. This kind of foresight makes you the calmest trader in the room – and one of the most profitable.

Learn to Trade News, Headlines, and Economic Shifts

News events can ruin trades – or create them. FX Masterclass 2.0 helps you master how to handle headlines, planned events, and economic releases without panic. You’ll learn how to prepare for volatility, react with clarity, and turn chaos into opportunity.

Instead of guessing, you’ll follow a structured process that makes news trading logical and consistent. Uprise shows you when to enter, how to protect capital, and how to use market reaction to your advantage.

You’ll learn how to measure event significance, anticipate market impact, and trade accordingly. The course teaches you how to separate noise from signal, and how to use tools like the economic calendar and news alerts effectively.

You’ll also build the mindset to stay calm while others panic – because you’ll know exactly what to look for. Major data drops won’t surprise you. Central bank moves won’t rattle you.

You’ll have a system that uses news volatility to improve results. This gives you a professional edge in one of the most unpredictable areas of trading – and it works in every market condition.

FX Masterclass 2.0 Gives You Complete Charting Confidence

If you look at a chart and feel overwhelmed, this course changes everything. FX Masterclass 2.0 teaches you how to read price action like a pro. You’ll learn structure, entry logic, and how to time your trades with real conviction.

No more guessing or copying others. You’ll build your own charting skillset from the ground up, using proven concepts that work across all markets and timeframes.

Market Structure and Entry Precision

You’ll master candlestick patterns, multi-timeframe confluence, and market structure shifts that signal where price wants to go. Uprise walks you through each step – from identifying trend to refining entries based on support, resistance, and confirmation.

This isn’t generic TA. It’s a step-by-step system that shows you how to trade what you see, not what you feel. Once you understand chart behavior, you’ll never chase price again. You’ll know when to wait, when to enter, and when to get out. That kind of clarity turns you from a reactive trader into a focused, confident operator.

Uprise Academy’s Step-by-Step Guide to Profitable Forex

Most traders jump in with no plan, no process, and no patience. FX Masterclass 2.0 was built to fix that. It’s a step-by-step blueprint for building a profitable trading system from scratch – whether you’re new or already experienced. You’ll move through nine precise phases, each building on the last, so nothing gets skipped or rushed. It’s the exact system Uprise Academy has used to train over 10,000 traders worldwide.

Nine Phases of Trading Mastery

You’ll start with market basics, then build technical skill, trading psychology, and finally advanced strategy – like intermarket and sentiment analysis. You’ll also learn how to create your own trading plan and track performance like a pro.

By the end, you won’t just know how to trade. You’ll know how to stay profitable, adapt to market changes, and grow consistently. This isn’t a quick fix. It’s the long-term solution traders actually need – but rarely find.

Learn to Spot Market Sentiment Before It Moves Price

Market sentiment drives behavior – and behavior drives price. FX Masterclass 2.0 gives you the tools to measure sentiment and act on it before everyone else. You’ll learn how to spot fear, greed, indecision, and euphoria in the charts.

These shifts often happen before technical confirmation, which gives you a major edge. Once you master this skill, you’ll understand why the market moves the way it does.

Sentiment Shifts and Volatility Clues

Uprise Academy walks you through sentiment indicators, market correlation reactions, and narrative shifts that precede price movement. You’ll study how headlines, fear-based moves, and institutional behavior signal trade opportunities.

Then, you’ll learn how to act with clarity. Most traders wait for confirmation. You’ll learn how to anticipate moves by reading emotion in real time. This makes you faster, sharper, and far more consistent when volatility spikes. Instead of reacting late – you’ll already be in.